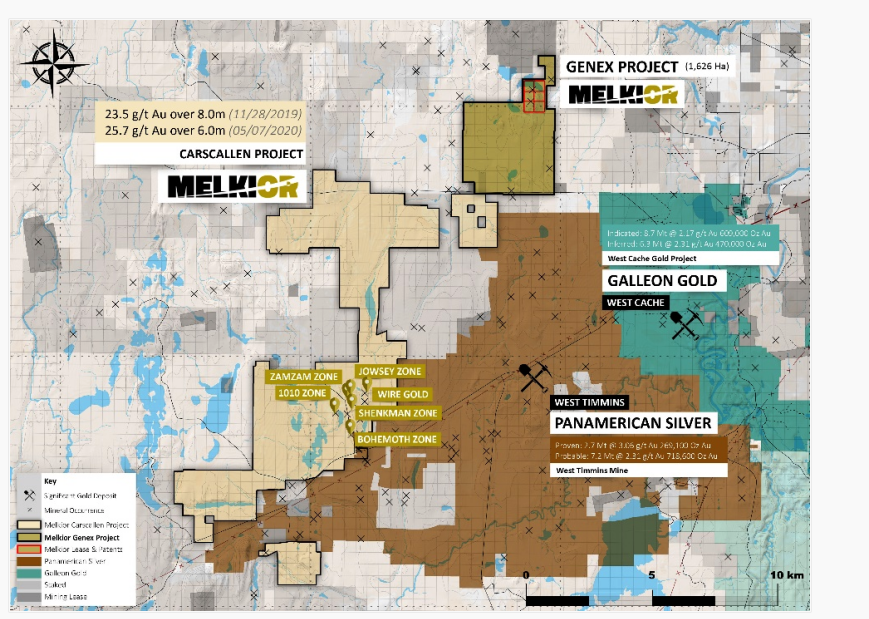

Timmins, Ontario – TheNewswire – July 21, 2022 – Melkior Resources Inc. (“Melkior” or the “Company”) (TSXV:MKR) (OTC:MKRIF) is pleased to announce that the TSX Venture Exchange (“TSXV”) has approved its previously announced option agreement (the “Agreement”) to acquire 100% of the Genex Project (“Genex”) from International Explorers & Prospectors Inc. (“IEP”). The Genex Project is located approximately 20 kilometres west of Timmins and borders Melkior’s Carscallen Project on its northeast boundary.

The TSXV approval will allow the Company to make the initial cash payment and issuance of 500,000 common shares to IEP to begin the earn-in for Option 1 as described further in this news release.

The Genex Project is an advanced gold-copper VMS exploration target with significant near-term resource potential. The zones have been historically interpreted over approximately 300 metres wide with a sub-vertical dip. Historical drilling completed along strike and across inside 500 metres of a strongly altered volcanic sequence revealed satellite gold-copper mineralization that proves the expansion potential of the system.

Project Summary:

Location: The Genex Project is located in the Kamiskotia volcanic belt extending northwest of Timmins. The Project is made of 70 claims, 6 patents and 1 partial lease totaling 1,616 hectares with good access. Underground workings including a 84-metre deep shaft and lateral development on two levels, were completed between 1964 and 1966.

History: The Kamiskotia area saw significant base metal production during the fifties and sixties, led by the Kam Kotia mine with 6.4 million tonnes of ore produced at a grade of 1.11% Cu and 1.17% Zn1. The Genex Project was in production between 1966-1967, where it shipped 240 tonnes of concentrate at 21.45%-27.25% Cu (No zinc or gold recovered)2. Genex hosts a historical resource (non-compliant NI43-101) of 1 Million Tonnes of Copper using a cut-off grade of 1%2, which Middleton calculated in 1975. No gold or zinc values were calculated in this historical resource. A qualified person for the Company has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves, and the Company is not treating the historical estimate as current mineral resources or mineral reserves. The Company is disclosing the historical resource as it believes it is relevant. During its due diligence on Genex and prior to entering into the Agreement, the Company also completed the evaluation work described below.

Geology: The Genex mineralized zones are enclosed in a 500-metre window characterized by a strong hydrothermally altered felsic to mafic volcanic sequence. Known mineralization takes the form of gold – chalcopyrite bearing stringers, impregnated breccia and silica-rich structures. The general trend of the mineralization is nearly north-south, possibly controlled by a tight regional folding axis. Recent geochronology data indicate a Blake River ages (2,698 My) for this portion of the Kamiskotia volcanic sequence, the age, bimodal volcanism and mineralization styles are similar to those of the Horne Mine environment at Noranda3.

Evaluation: IEP has compiled an extensive surface sampling, geophysics and drill database. The Company during due diligence, completed a preliminary 3D model with initial drill targets based on 45,000 metres of historical drilling across 112 holes. The drill coverage consists of a combination of clustered short holes concentrated along the 500 metres strike length. The Genex Project was in production between 1966-1967, and was thereafter covered by 200 metre widely spaced sections drilled down to a maximum depth of about 700 metres.

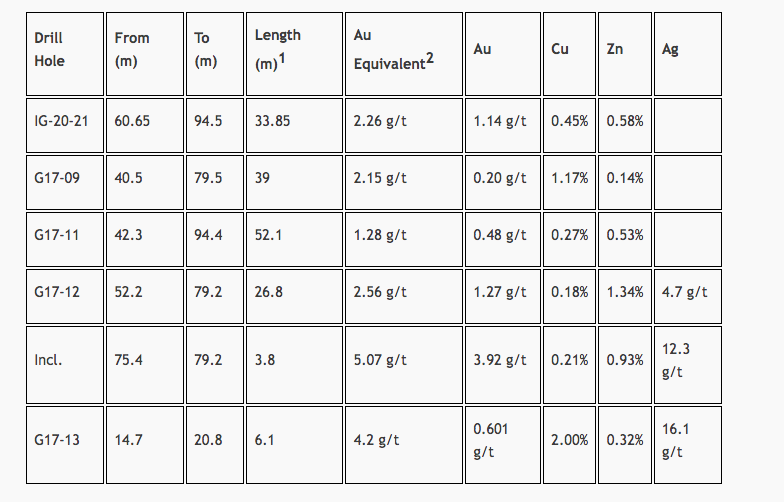

A series of three closely related holes drilled by IEP between 2017 and 2020 close to Genex historical mineralized zones were assayed over long sulphide bearing core sections which returned results ranging from 1.3 g/t Au Eq to 2.55 g/t Au Eq over a length of 26m to 52m starting from surface down vertical depth of 100 metres. This type of metal distribution highlights the near-surface potential of wide mineralized envelopes. Further modelling should demonstrate how to orient this new mineralization and target extensions through drilling.

A summary of selected historical drill results is reported in Table 1:

Notes:

True widths of mineralization are not known.

Gold equivalent grades are based on the following metal prices: gold US$1,950 per oz, zinc US$2.00/lb, copper US$4.50/lb, and silver US$25.5 per oz. Metal recoveries of 100% are applied in the gold equivalent calculation.

Gold Equivalent values (AuEq) were calculated using the formula AuEq = (($1950 x Au g/t ÷ 31.104) + ($25.5 x Ag g/t ÷ 31.104) + ($4.5 x % Cu ÷100 x 2204.63) +($2.0 x % Zn ÷100 x 2204.63)) ÷ $1950 x 31.104

Terms of the Agreement:

Under the terms of the Agreement, Melkior has a right to earn 100% interest in the Project through two options, subject to a net smelter return royalty of up to 2.25% on certain of the claims, by:

Option 1: In order to earn an undivided 50% interest in the Property (the “First Option”), Melkior must make total cash expenditures of $250,000, issue 2,500,000 common shares in the capital of Melkior to IEP, incur Work Expenditures of $2,750,000 and contribute $500,000 in assessment credits from Melkior’s Carscallen project, all in accordance with the anniversary dates in the table below:

Date | Cash | Shares | Work Expenditures | Credits |

20 days from the Effective Date | $50,000 | issuance of 500,000 common shares | NA | $500,000 in assessment credits from Melkior’s Carscallen Project |

On or before the first anniversary of the Effective Date* | $50,000 | issuance of 500,000 common shares | $750,000 in aggregate Work Expenditures | NA |

On the second anniversary of the Effective Date* | $50,000 | issuance of 500,000 common shares | $1,750,000 in Cumulative Work Expenditures | IEP is permitted to remove $500,000 in assessment credits from the Genex Property during Year 2. |

On the third anniversary of the Effective Date* | $100,000 | issuance of 1,000,000 common shares | $2,750,000 in Cumulative Work Expenditures | IEP is permitted to remove $500,000 in assessment credits from the Genex Property during Year 3. |

* The agreement has an Effective Date of May 16, 2022 for all anniversary payments.

Option 2: To exercise the Option to acquire an additional 50% interest (the “Second Option”), for an undivided 100% interest in the Property, Melkior must within four years after exercising the First Option:

a)Make a one-time issuance of 2,500,000 in common shares of Melkior (the “Second Option Payment”) to the Optionor. The Second Option Payment will be paid in common shares of Melkior.

If the Second Option is not exercised within the applicable four year period to fulfill the Second Option, then a Joint Venture will be formed with 70% interest being held by Melkior and 30% held by IEP. If the Second Option is exercised, then Melkior will own a 100% interest in Genex and IEP will retain a net smelter return royalty of up to 2% calculated as the difference between 2% and any amounts payable pursuant to any existing royalties, of which various portions of the Genex Project have existing royalty interests covering them.

All common shares of Melkior issued under the Agreement will be subject to a hold period of 4 months and one day from the date of issuance.

Qualified Person

All technical information in this press release has been reviewed and approved by Peter Caldbick, P.Geo. Mr. Caldbick is a consultant for Melkior and a Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Jonathon Deluce, CEO

For more information, please contact:

Melkior Resources Inc.

E-mail: [email protected]

Tel: 226-271-5170